“In this world nothing can be said to be certain, except death and taxes.”

According to polling, Inheritance Tax is the most unpopular tax in the UK.

You pay taxes on your work, you pay taxes on your spending, you pay taxes on your travel, you pay taxes on your investment gains, you pay taxes on your pension and right at the end of your life the government takes their final slice.

With changes announced in the latest Budget set to increase the levels of Inheritance Tax collected by the government in the coming years, here are a few things you might not know about this dreaded tax.

#1 – Inheritance Tax is paid on your worldwide assets

Moving your wealth abroad does not allow you to escape the Tax net.

Even moving yourself abroad may not shield you from paying Inheritance Tax.

This is because Inheritance Tax is based on where you are domiciled. As in where your permanent home is.

Where you are domiciled is different to where you can be resident.

You can be resident in a different country and pay taxes on your income and investments in that country but if you are still domiciled in the UK, you will pay Inheritance Tax on your worldwide assets.

Based on current rules HM Revenue and Customs (HMRC) will treat you as being domiciled in the UK if you either:

- Lived in the UK for 15 of the last 20 years.

- Had your permanent home in the UK at any time in the last three years of your life.

Your executors may be able to reclaim some tax if your assets are also taxed in another country that has a double taxation agreement with the UK.

#2 – Inheritance Tax is due by the end of the sixth month after death

Your executors must have calculated and then paid the actual Inheritance Tax bill to HMRC within six months of your death.

This isn’t actually as much time as you may think as the first few weeks after someone close to you passes can be a blur, with time spent arranging the funeral and other tasks.

You may need to gather family together who are spread across the country or the globe to go through the probate process. It may take a while to get an appointment with a solicitor and it could take even longer to value all of the assets in a complex estate.

#3 – HMRC charge interest on late payment of Inheritance Tax

One of the problems with HMRC’s rather short deadline for paying Inheritance Tax is that if you have an asset like a property, it can be difficult to sell this within the time period.

You might need to sell it to release the funds to pay the Inheritance Tax bill.

HMRC do allow you to pay the Inheritance Tax in yearly instalments for up to 10 years for things that take time to sell, but they will charge you interest.

From April 2025 HMRC will charge an interest rate of bank base rate (BBR) + 4% on the late payment of Inheritance Tax.

Using today’s base rate of 4.75%, this would be an interest rate of 8.75%.

HMRC do provide an Inheritance Tax Interest Calculator to help you work out the total amount that could be owed including interest.

There are providers out there like Ampla (not a recommendation) who provide Inheritance Tax loans.

#4 – There is no limit as to what you can gift away

You may have heard of the annual gift exemption which is £3,000 per tax year.

This is the amount you can give away in total in one tax year without any Inheritance Tax implications.

There are a few other smaller allowances you can use for things like marriages and birthday gifts.

However, there is in fact no limit as to what you can give away.

If you really wanted to, you could give away £10million straight to your children and there would be no immediate tax liabilities. This is called a Potentially Exempt Transfer (PET).

There will only be a tax issue if you did not survive for seven years after making the gift. This is known as the ‘seven-year rule’.

#5 – It’s not seven years of full Inheritance Tax

If you were to die within seven years of making a gift over your annual gift exemption it might not be the case your beneficiaries pay full Inheritance Tax on the gift.

Firstly, the rest of your estate may be under Inheritance Tax thresholds anyway so no Inheritance Tax would be due in that scenario.

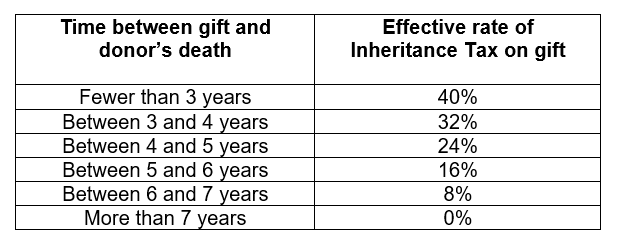

If Inheritance Tax is due on the gift, then the amount due actually reduces over the seven-year period as follows:

So even after three years there is a meaningful reduction in Inheritance on the gift.

The thing about Inheritance Tax is that there is still lots of planning you can do to avoid it, even after the changes announced in the latest Budget. You just need to find that balance between what you need to live on, what you’re prepared to give up and how much control you want over any gifts.

If you would like to stress test your legacy planning or even to get a plan in place then please get in touch for a free no obligation 15-minute call. We would be happy to review your position, explain where you stand and what you need to do to get the outcome you desire. We have created hundreds of happy and protected retirements over the years. This could be you too.